In the last lesson we talked how to save, and use automation to transfer your hard earned money into a investment account. Today we'll talk how to invest.

How the invest took me a while to learn. Initially I would just put my money in a savings account. But that is no longer viable and even though the risk seems low (you balance does typically not go down) there is a risk which is inflation risk. Where inflation rate is higher than your interest returns. Typically you will also need to pay tax on your earned interest. And lets not even talk about the low interest rates we currently have.

Back then while still living in the Netherlands I already had some experience with investing in some sector funds. These are funds that invest for you in companies in particular industry. I invested in an IT fund which worked pretty well, but I kept buying and selling try to time the market. Timing the market is when you try to by when the price is low and sell when the price is high.

Another strategy that was unsuccessful was to but mutual funds based on their passed performance. After I moved to the US and had access to various mutual funds through my employer I would look at the mutual funds which had a good past performance and assumed that performance will continue. Typically it didn't.

I then read a book the Intelligent Investor by Benjamin Graham, which explains how to look at fundamentals of a company. It is what is called value investing. Basically if a company performs well it will automatically result in a better stock price. Warren Buffet is an example of a value investor.

When I applied my new knowledge, I found a company that year of year increased profits and dividends. I remember it well, the ticker symbol was ASVI. A few weeks after I bought it, the stock tanked. Turned out the demand for their product went down. Why does value investing work for Warren and not for Henry. Warren has a large team of professionals to analyze and monitor a company's performance and at the first bad sign sell its stock. Where Henry does not have time and deep knowledge to do that and only see the declining performance when it is too late, after the stock price dropped.

So lesson learned here is to not invest in individual companies, but to invest in funds that are invested in a large number of companies. So in case a company goes down it is only a part of your investments. And when companies do well they automatically get added to the fund.

In respect to chosen a fund, the larger the amount of companies the less risk. Now the next thing to look for is cost of a fund. A lot of funds are actively managed which means a team of experts is handpicking stocks. These funds typically have a high expense ratio. From 1% to 2%. If the stocks in the fund have a return of say 5% you now have to substract these costs. Leaving the fund only with a return of 4% to 3%.

A lower cost option is an index fund, these funds just follow an index, and can keep staff and therefor costs low. For example the Dow Jones Index or the Russell 2000 index. These passively managed funds have a much lower cost ratio. For example the Vanguard 500 Index Fund (VFIAX) has an expense ratio of 0.04%. If the $3000 start invest is too steep you can start with the ETF VOO with cost ratio of 0.03%. ETF you typically pay transaction fees to buy and sell.

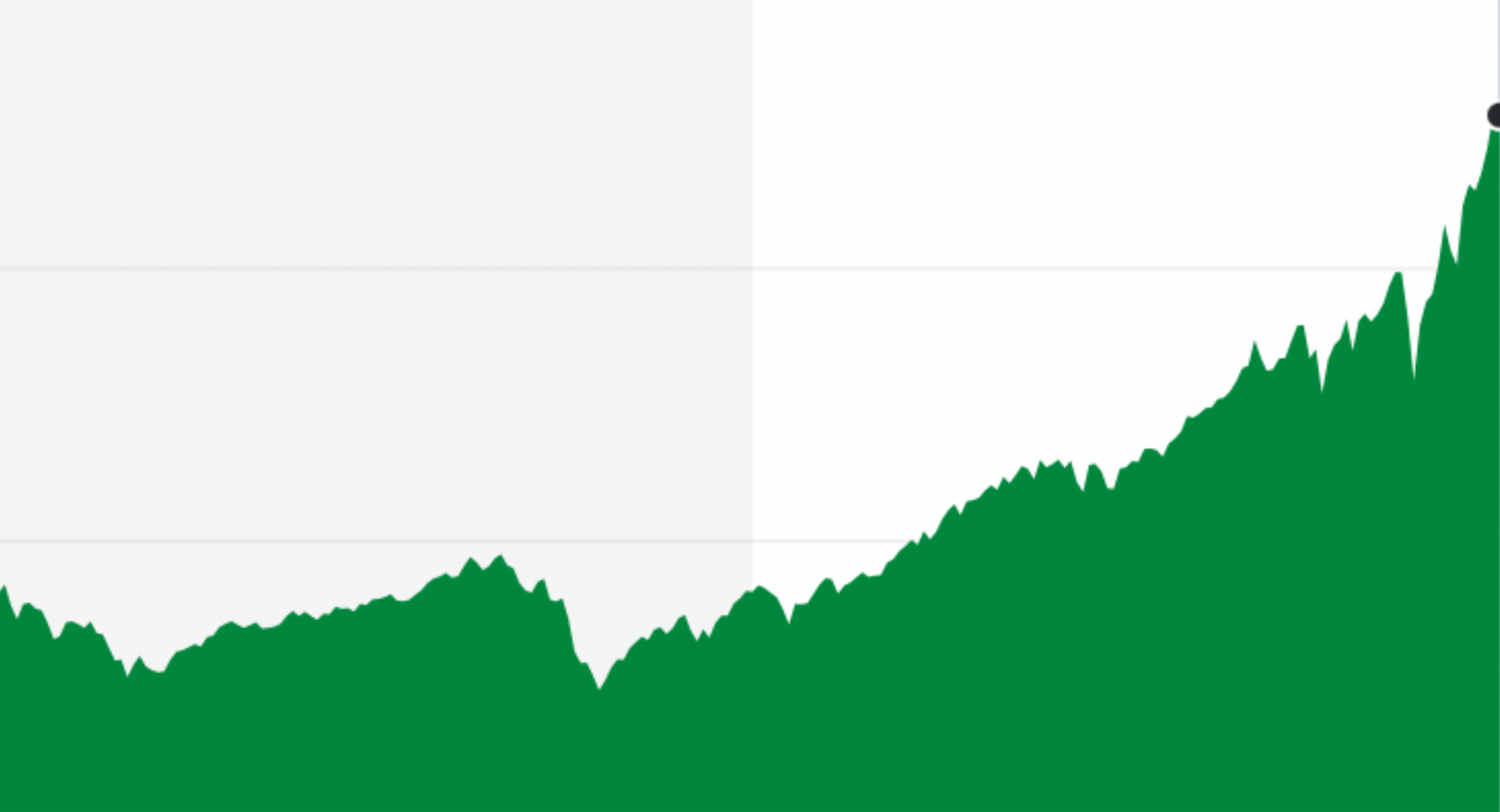

Now these index funds follow an index, and you may wonder if that gives a good return. Turns out that S&P 500 index had an average return of 7.5% from 1957-2018.

To summarize keep things simple, just invest in a low cost index fund like the Vanguard 500 Index Fund (VFIAX) and then forget, the market will take care of an average of 7.5%.

The book The Simple Path to Wealth by JL Collins provides some good advice about investing using index funds.

Oh and do not try to time the market, just let it be. It has shown that stock market crashes like in 2008 or 2020 recover in a short time.

Full disclosure I own a number of index funds and also cash reserves for diversification. More on that in another lesson. If don't need your savings any time soon just investing in VFIAX will suffice.