Since I arrived in the US I have always payed off the monthly balance of my creditcards, ok perhaps with an exception or 2.

Creditcards are convenient, can earn you miles and postpone your payment interest free of your purchase up to two months. The last is a blessing but also a curse. As it detaches the money you spend from the money you have now.

I tried a few things, paying just with a debit card or with cash but I was then missing out on miles. Also cash does not work with online payments. Other benefits of a creditcard are that you can challenge charges and depending on the creditcard you purchase is insured.

So I went back to creditcards and since a few months finally have a great working solution. I call it the Henry credit card payment system.

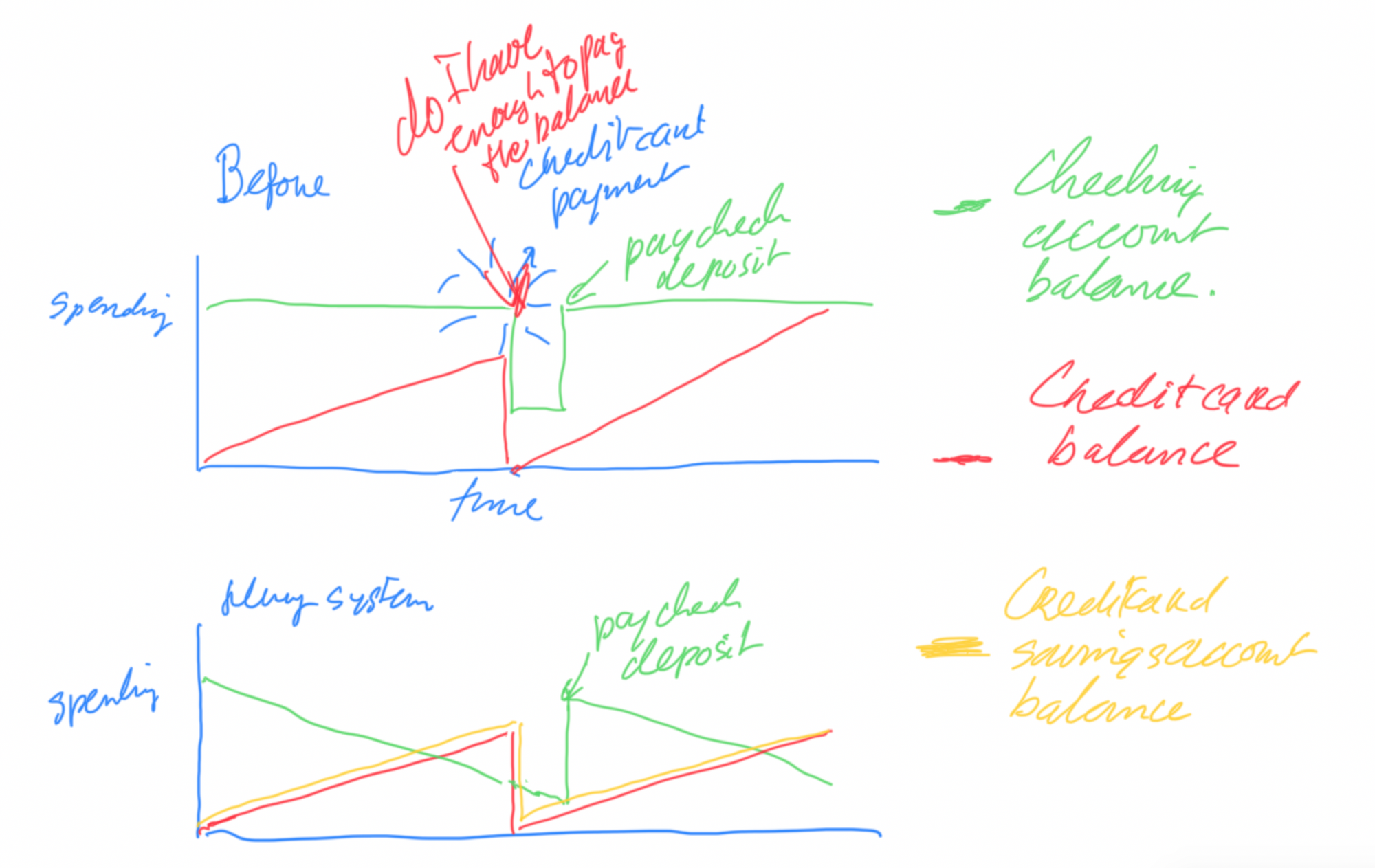

In an earlier post (Lesson 3, how to save) I talked about paying yourself first to save for your retirement. The Henry Credit Card Payment system is a variation of that. The idea is that the money in your checking account and the money in your wallet are truely representing what you have and can spend. It is not tied up for some future bill or creditcard payment.

It works as follows; everytime you make a purchase with a creditcard, move the same amount of money from your checking account into a seperate creditcard savings account. Once the creditcard bill is due 1-2 month later you can transfer it back to your checking account to cover the creditcard withdrawal. Even better is what I do, I use a money market account and the creditcard automatically withdraws from there. So I don't even have to think about it anymore.

This will result into two benefits, well actually five. I'll discuss these now.

First and the most important one is that the money is out of you checking account and your checking account reflects the amount you can spend. Second the money you moved to your creditcard savings account is now earning interest.

The last three benefits are more psychological. The third benefit is that you now feel in control of your spending (the balance of your checking account truely represent what is still available) The fourth benefit is (especially if you let the creditcard company withdraw directly from your Creditcards savings account) that it is set and forget. The fifth and last benefit is that you are actually confronted on a daily basis of the amount you payed for a purchase and how it impacts your remaining balance.

There are a few practical things to think about. One is that to get this started you need to make up for the 2 months of debt (your outstanding balances with the creditcard company). If you have enough cash in your checking account you can just transfer that to your creditcard checking account. If not, you can try what I did, basically limit creditcard spending for two month and what you do spend move to your credit card account. Pay the last 2 months of bills from your regular checking and then after 2 months you should be all good.

Second every day you need to do a quick check on your creditcard payments from the previous day and transfer the equivalent amount to your creditcard savings account from your checking account. This is the key.

To make the latter easier you can make a tally of all your fixed bills you pay with your creditcard for a month and setup an automatic transfer every month or twice a month when your salary comes in. The more automation the better.

Having worked with this system for a few months now I really love it. I was always a bit stressed out if I would have enough money in my checking account to cover the creditcard payment. It forced me to keep track of my cashflow to ensure I would have enough. Also I would overspend as the bill would come later. Now I see my checking account move closer to zero and ease of on the spending until my next paycheck arrives.